How Banking Local Stimulates Your Local Economy

Recently Posted

There’s a sense of pride when contributing to your local economy and supporting your community’s businesses. However, did you know that you’re promoting the economic health and well-being of the residents within your community? Banking local is a part of this economic cycle that helps our communities thrive and become more resilient. Banking local is a must, and we’ve outlined reasons why you should consider local.

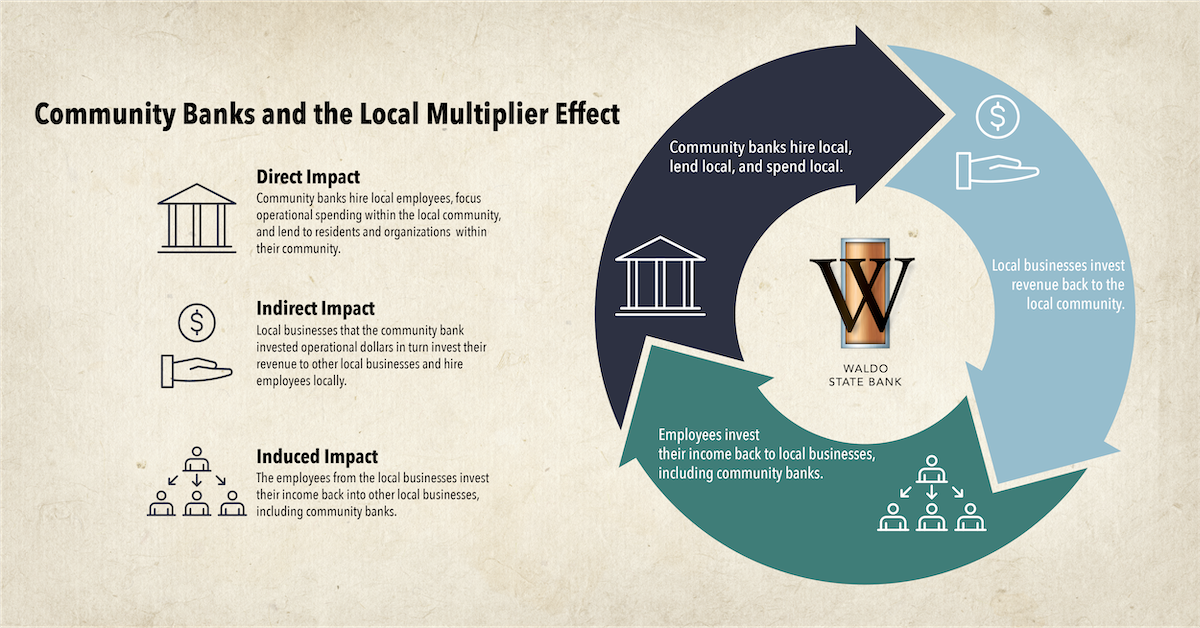

Community banks, like Waldo State Bank, support so much more than just providing a safe environment for your hard-earned dollars. Community banks are an integral part of the 3-part local multiplier effect. This phenomenon comes from the re-circulation of money throughout the local economy and the many benefits that come from this re-circulation. Here are the three ways community banks impact the local economy within the local multiplier effect:

Direct Impact: Hiring and Buying Local

Like Waldo State Bank, community banks hire employees locally and focus their operational spending within the local community’s businesses. This includes purchasing inventory, utilities, and equipment, thus directly impacting the economic health of the community through this effect. Community banks also work with local businesses to manage and grow their businesses by offering their lending power. Community banks support individuals building homes, purchasing vehicles from local dealers, and continuing local business operations through their lending power. When community banks profit, they also reinvest their profits back to local community organizations to help support the non-profit sector. More often than not, the non-profit organizations they support are local as well.

Indirect Impact: Supported Local Businesses support other businesses

Those local businesses hired by the community banks for operational purposes invest their earnings in hiring locally and supporting other local businesses.

Induced Impact: Community residents investing back into the Community

This is the natural occurrence of additional spending done by our employees and the business owners we support. They purchase goods and services for themselves and their families, helping to stimulate the economy.

This method of stimulating the local economy has shown that independent and locally-owned businesses recirculate about 58% more revenue within the local community than large franchises and corporate companies. The local multiplier effect creates an economic infrastructure that provides a healthy foundation for the residents and the community to thrive.

Waldo State Bank is proud to be a locally owned, independent establishment that supports our businesses and its residents through the local multiplier effect. We believe in our community and its people and will continue to invest in you. Contact us for your banking needs and contribute to the local multiplier effect today!