Community

Apples in Two Ways!

Apple Crumb Cake featuring Cinnamon Baked Apples - this is really two recipes in one! Plus it gives you an "easy" or "homemade" option that involved a little more work but also has your home smelling delicious!

Community

Pigs, and Cows, and Sheep... Oh My!

The Sheboygan County Fair is the hot spot for residents over Labor Day weekend, and Waldo State Bank was proud to be represented on the grounds throughout the run of events!

Security

Let Me Protect Your Money For You!

Have you been contacted by a business for a problem with your information, but they ask you to move money to help fix it or to 'protect' it? Well, you may want to call the ACTUAL business!

Community

Chicken Salad

Perfect for hot days! It can be served alone, over lettuce, with crackers as a dip, or as a sandwich on your favorite artisan bread!

Community

Heavenly Cheesecake with Cherry Compote

Why is it heavenly? Because it is so light and creamy there are no other words to compare it to!

Security

Prime Day is the Prime Time

The best time of year for deals... and for scams

News

Team WSB is Working Hard!

We are halfway through 2025 and there has been some excitement within the WSB Team!

Community

Strawberry Cream Crumble

Fresh strawberries are right around the corner and what better way to enjoy them than in this delicious treat!

Security

Devices Are Taking Over

Whether your only device is your phone, or you have a device system within your home, it is important to know how to have maximum security for your information.

Community

Picnic Salad

Versions of this have been in our family for years. Here is a higher protein version that is delicious and still mimics mom's old fashioned picnic salad!

Security

Hey! You Owe $$$

Do you owe money on a toll you never went through? That text can be more than spam!

Community

April - By The Numbers!

April was a busy month, so let's take a look at it... by the numbers!

Community

Banana (Nut) Bread

Everyone has their favorite go-to banana bread recipe, yet this one is really worth trying and comparing! Surprise mom on Mother's Day with your baking skills!

Security

Alert! Alert! Scammer Ahead!

Know how to protect not just yourself, but also your money, from scammers.

Community

Maple Cookies

It’s the perfect time of year!! Maple Season! These cookies feature locally sourced pure maple syrup. They are easy, fun and best of all: melt-in-your-mouth delicious!

Security

It's A Trap!

Are those notifications you've been getting really notifications? Or is it a trap?

Security

Your Personal Internet Bodyguard

What is a Personal VPN? And how does it protect you and your data?

Community

Expanding Waldo State Bank: We Are Almost There!

The doorways have doors, the ceiling has lights, and the walls have color!

Community

Valentine's Special!

Spoil your loved one by indulging them with a romantic meal made with love!

Community

25 Years and It's Time to Golf!

Last week Tom Reil, golf enthusiast and Waldo State Bank CEO, retired after 41 years of banking, and we are reminiscing about his very exciting last day of work as he received a very special award!

Community

Chicken & Green Chili Dip

aka Cody’s Dip – recently, WSB had a dip-i-licious day. Dana shared her friend Cody's dip and it was a huge hit. And now you have it just in time for the Super Bowl; this dip is unique and delicious!

Security

Did I Order This?

The Secrets Behind Shipping Scams and Fake Package Deliveries.

Community

Holiday Ham Spread

Looking for another ham recipe!?! Here is a perfect dip for your New Year's Eve gathering!

Community

Expanding Waldo State Bank: A New Chapter in Community Banking

As Waldo State Bank embarks on expanding its office space, this growth symbolizes more than just physical expansion.

Community

Holiday Ham Quiche

Ham is our December theme! Did you get your Christmas Ham yet? This recipe is perfect for your leftover ham.

Security

Does AI Affect You?

AI - You see it, you hear it! How does it affect you? If it hasn't already, it will in the near future.

Community

A Holiday Message from Our President

As we embrace the festive spirit of the holiday season, I extend my heartfelt gratitude and warmest wishes to each of you.

Banking

Introducing B.O.B.: Your New Business Partner at Waldo State Bank

Meet B.O.B., not just a platform but your business banking partner at Waldo State Bank (W.S.B.)! When you open a deposit account with us, B.O.B. comes to life, ready to cater to your every financial need with precision and personal attention.

Community

WSB Awards $33,000 Grant!

Waldo State Bank in cooperation with the Federal Home Loan Bank of Chicago was pleased to present to Danielle Beining and Keri Grotelueschen with the 2024 Community First Accelerate Grant for Small business in the amount of $33,000.

Community

Cranberry Orange Scones

Easy! I've always been intimidated by Scones. I've mastered several fails - from rocks to blah lumps! But this recipe has proven over and over that even those of us who are scone challenged can create a masterpiece. Bring Cranberries to your Thanksgiving Feast with a twist!

Enjoy!

Security

Porch Pirates

Have you heard of Porch Pirates?

Community

Opening the Door to Home Ownership

Ready to buy your first home? The Consumer Credit Counseling Service is putting on a free workshop November 2!

Community

Beer Breads & Beer Dip

Tailgating Time! These breads will impress and pair perfectly with this delicious dip. Spice it up or keep it plain - something for everyone! Enjoy!!

Security

Banks NEVER Ask That!

Phone Calls, Text Message, Emails, OH MY!

Banking

Mortgage Loans Made Easy with Waldo State Bank (WSB)

Are you looking to buy, build, or even refinance your home in Wisconsin? Waldo State Bank (WSB) offers a range of mortgage loans, quick loans, and HELOC options tailored to meet your and your family's needs.

Banking

Trusted Lending Solutions from Waldo State Bank

To secure financing for business or personal use (or both), look no further than our team at Waldo State Bank (WSB). We are committed to providing commercial lending loans with personalized customer services.

Community

How Coaching Football Influences Jordan Mueller's Career in Banking

By balancing his high school football coach role and banking professional role, Jordan Mueller has gained unique insights and transferable skills in both fields.

Security

College Scams to be alert for!

As we are officially back to school, there are new scams that continue to prey on college students.

Community

Apple Bread

Fall is synonymous with apples. This old time apple bread is handed down from generations. Enjoyed by many and a delicious addition to any table!

Banking

Waldo State Bank – Here for You at Every Stage of Life

Whether starting your first job for savings, getting ready to buy a home, or running a successful local business, Waldo State Bank (WSB) proudly offers personalized financial solutions to help you meet your goals.

Security

Scammers Target Young Adults

Social Media has revealed another scam targeting young adults.

Community

Maple Balsamic Dressing & Summer Salad

This summer salad is even tastier using local products! This tasty treat is perfect for those hot weather days!

News

Waldo State Bank Awarded $10,000 Housing and Economic Development Grant

MADISON, Wis. – The Wisconsin Bankers Association (WBA) is pleased to announce that Waldo State Bank has been selected to receive one of five $10,000 awards to support housing and housing literacy, economic development/community investment, and financial or cyber literacy in Wisconsin.

Community

WSB Announces Promotions

As we continue to look toward the future, WSB is making changes to grow with the community!

Security

Fraud Center Calling

Ring! Ring! Who's calling you? Is it really my bank? How do I know?

Community

O'live 4U - July Recipe

Love olives? Need a unique appetizer for your Summer BBQ? This is the recipe for you! Four simple ingredients combined make a mouth watering combo!

Community

Going Away to College? Bring WSB with You!

Heading off to college is a significant and exciting milestone. While plenty of changes are on the horizon, the worries of managing your finances won't be present with the mobile bank of WSB.

Community

Elder Abuse Awareness Month

June is Elder Abuse Awareness Month, and the team at Waldo State Bank (WSB) wants to raise awareness about the abuse that many older adults face. According to the Center for Elder Justice and Education, an estimated one in ten Americans aged 60 years or older have experienced some form of abuse.

Community

Blueberry Torte

Cool, Refreshing, Tasty, Easy! What more could you ask for? This delicious treat is brought to you compliments of Crystal who recently shared this with our fellow employees. It was a huge hit and I knew right away it would be with you too!

Community

Yes, We Can! The Strengths of Community Banking

Although Waldo State Bank (WSB) is smaller than national banks in Sheboygan County, we offer the same services and more, including high-yield checking accounts, free checking accounts, and personal loans. We appreciate our customers choosing us as their bank and trusting us to help them achieve their financial goals.

Security

Who Signed into my Account?

Random Texts, Random Emails - sent directly to you on your phone!

Community

Broccoli Onion Casserole

Anytime is a good time for this delicious side dish! Unique enough for special occasions, but tasty enough for everyday meals.

Community

Highlights from Community Banking Month 2024

April marks the celebration of Community Banking Month, highlighting the incredible benefits of local banking for businesses and individuals.

Community

Homemade (Semi) PopTarts

Looking for a fun, delicious project with kids or grandkids? I can highly recommend this one!

Security

Securing Online Accounts

Online Banking - Staying Safe!

Community

Danish Apple Bars

The best recipes can be handed down through generations. A recipe enjoyed at Grandma Sweetiepie's House over 50 years ago and still a favorite!

Banking

Understanding Money Market Accounts: A Beginners Guide

Aside from a standard savings or checking account, more deposit options are available. WSB offers accounts that are safe and dependable, yet money market accounts can provide better returns with less risk. For more information on low-risk savings and short-term investment options on money market accounts (MMAs), continue reading below.

Security

QR Codes - What you need to know!

Are they safe? Who do you trust?

News

Waldo State Bank Promotions

Waldo State Bank is more than a financial institution. We're a family that grows with our community! We are committed to nurturing an environment that not only focuses on the growth of our customers but also on the professional development and success of our team members. We're thrilled to celebrate the achievements of our dedicated team members who are stepping into new roles at WSB.

Banking

How to Get the Most out of Your Certificates of Deposit (CDs)

Whether you have a specific savings goal or want to save more this year, a certificate of deposit (CD) could be a great vehicle to help you get there. With a guaranteed rate of return, CDs offer you a low-risk way to invest your money.

Community

Super Bowl Corn Dip

Have you ever come across a recipe on Facebook, or even in a recipe book, that just looked so good you had to try it? That is this one! It didn’t even have a name – at least not on the screenshot someone else shared, but I knew I had to try it. Turned out, it was a huge success! So, I’m calling it the Super Bowl Corn Dip!

Community

Upside Down Pineapple Cakes

These individual cakes are just the perfect size and pack a punch of pineapple flavor!

Banking

How a Personal Line of Credit Can Help Cover Unexpected Expenses

As you kick off the new year, you might have a goal to be more strategic with your finances in 2024. If you’re looking for more flexibility in managing your cash flow and want to know how to be covered when it comes to unexpected expenses, consider opening up a personal line of credit (LOC).

Security

Technology for Kids of All Ages

Technology is everywhere! But as parents we have concerns.....

Community

A Shopper's Guide to Saving and Smart Gifting

The holiday season is here, and while this time of the year is filled with joy and cheer, it can also bring about some money worries if you aren't properly prepared. For any money-conscious person, the approaching holiday season can make you think about your increased spending to buy gifts for your loved ones.

Community

Holiday Taco Wreath

Holidays are for gathering with friends and family and usually center around food! This Holiday Taco Wreath is not only impressive looking, but delicious and easy!

Community

Thanksgiving Dessert Time!

Creme Brulee has always intimidated me! Not anymore! This Pumpkin Creme Brulee is delicious and so easy!

Security

Open Enrollment Time of Year!

The buzzwords this time of year are "Open Enrollment". Scammers can also be taking advantage of you at this time of year!

Community

Christmas Giving

Tis that time of year again.....

Community

Securing Online Banking Accounts

We all want the convenience of banking online. But, what should we know to be safe?

Community

Pumpkin Everything?

It is Pumpkin Season in full swing! These Pumpkin Cream Cheese Muffins are a wonderful addition to your Fall baking lineup!

Banking

A Beginners Guide to Opening and Managing a Bank Account

Opening an FDIC-insured bank account, like we offer at Waldo State Bank, gives you the peace of mind that your hard-earned money is stored safely away and growing with interest. So when you’re ready to start taking your saving goals seriously and want to open up a bank account, continue reading below as we walk you through everything you need to know about the account opening process.

Community

Tailgating Smoked Queso Dip

This recipe will be the hit of your tailgating event or any other party where a dip is needed. Or make a smaller batch all for yourself as this recipe is one that gets better with age!

Security

Back to School Security Tips

Back to School can mean many kids will now have their first phone. What are security tips on devices?

Banking

5 Strategies for Growing Your Savings

Regardless of your life stage, looking for strategies to help grow your savings is always a good idea. Growing your savings can help you become more financially stable and give you the peace of mind that you have a solid financial safety net.

Community

Back To School Protein Bars

Our own VP of Lending, Brian shares his Protein Bar Recipe that is better than any store bought!

Security

Taking a Vacation?

From fake survey sites to airline ticket scams, beware!

Community

Crab Rangoon Dip

There are many different recipes for Crab Rangoon Dip that I have tried, but I keep going back to this one as my favorite time after time. It is a cool and refreshing treat (or can be served warm too!) with your favorite Pita Chip, Cracker, or Crusty Bread. Enjoy!”

Banking

IRA vs. CD - Which one is right for you?

No matter your savings goals, you should consider all the savings products available to find the one that balances security and growth for you.

Community

Rhubarb Bread

Rhubarb Season is Here! This bread is easy and delicious. It makes enough to share - or not!

Security

Need Help Against Scammers?

Tech Scams disguised as helping you!

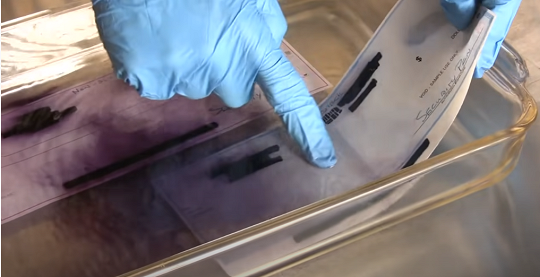

Banking

Check Washing - Making a Comeback

Old Fashion Scam - yes, but it's the latest fraud happening!

Community

No Bake Blueberry Torte

An old fashion torte that is quick, easy, few ingredients, and above all delicious!

Community

Waldo State Bank Gives Back in April

Giving back to the community is a rewarding part of our business, which we take pride in all year.

Community

Grilling Season is Here!

Guest Chef Brian (aka VP of Lending) shares with us these delicious chicken thighs. Just in time for grilling season, a recipe to add to your collection.

Security

Juice Jacking

Juice Jacking may sound like a good thing, but it can put your device and contents in jeopardy!

Banking

Get More Bang for Your Buck: Why CDs at WSB are a Game-Changer

No matter what you’re saving up for–a fun vacation, a new car, or holiday shopping–make your saving efforts count by opening a certificate of deposit (CD) with Waldo State Bank (WSB).

Community

Stacey's Jambalaya

This month's Jambalaya recipe comes to us compliments of our very own Stacey. She shared with the bank for our Mardi Gras day and it was an instant success!

Security

Phishing for Passwords

Scam Alert - Phishing scam using scare tactics on Facebook.

Banking

4 Steps to Creating an Effective Small Business Budget

At Waldo State Bank, we understand the importance of making well-informed decisions for your business. We believe that creating a carefully planned budget is the key to unlocking this potential. Our recommendations provide a simple guideline for crafting an efficient budget that can enhance your profitability. Let us partner with you to build an effective budget that sets your business on a path to success.

Community

Are you Sweet or Spicy?

Either way this months recipes have you covered!

Security

Alerts for your Accounts

How often are you monitoring your accounts? Need some help?

Community

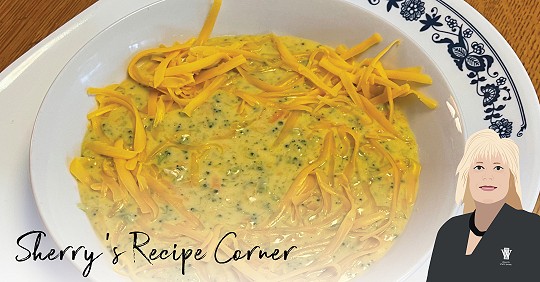

Broccoli Cheese Soup

This soup takes the comfort level not only up a notch, but over the top! You literally won't be able to stop earing it!

Community

Cheesy Pull Apart Bread - A Delicious Appetizer That Delivers!

Which turned out better? We sampled these at the bank, find out here which was best loved!

Community

Waldo State Bank's 12 Months of Giving

We are grateful for the opportunity to give back to local organizations that do great work. Our team at WSB will continue to support our community in any way we can!

Community

Thanksgiving Leftovers!

You may want to make double of your favorite stuffing recipe this year!

Security

Android User? High Risk Malware Apps

High Risk Malware Apps to be aware of!

Security

Protecting Your Children's Identity

Are Your Kids Identities Protected Online?

Community

Honey Balsamic Glaze over Smoked Pork

This glaze takes a pork loin (or any choice of meat and even seafood to the next level!

Banking

Benefits of Community Banking for Small Businesses

Community banks are vital to the communities they serve, supporting local residents and small businesses. Read about how your business can benefit from working with a community bank.

Community

Crockpot Cheesy Chicken Chili

Fall is the perfect time for this easy crockpot recipe

Security

Is Your Data at Risk?

Here are five ways your data may be at risk!

Banking

Using Certificates of Deposits (CDs) on Back-to-School Costs

Let's look at why CDs, like Waldo State Bank’s Scholastic CDs, are valuable for back-to-school, how you can open one today, and start compounding your savings.

Community

Old Fashion Carrot Cake

Carrots in your garden? No better way to use them then to turn them into something delicious!

Security

Crypto Assets - Are they Insured?

What is insured? FDIC Consumer News shares info on FDIC Insurance coverage.

News

Sizzling Summer CD / IRA Specials

CD / IRA Rates are on the rise We strive to help your money grow!

Security

Scams Targeting Sellers on Marketplace

Who doesn't like extra money? Unclutter your home and bring in the cash? Are there pitfalls?

Community

Unique Twists on Two Classic Favorites!

These all time classics are everyone's favorites! Here are some twists that should be tried!

Banking

Home Equity Line of Credit: Should you renovate your home?

Building or making improvements to your home can be a tough choice. Comparing both methods is a great place to start!

Banking

5 Steps to Increasing Your Personal Savings

While most people would agree that it’s important to save, according to a survey since the pandemic, 40% of Americans said they have less than $300 in their savings. So, if everyone thinks it’s a great idea but less than half of America is doing it, how can you be successful in saving money? Let’s break it down into five easy steps to increase your savings...

Community

Rhubarb Bars

Rhubarb season is in full swing! So many recipes yet this is one you may find yourself making time and time again. Easy and Tasty!

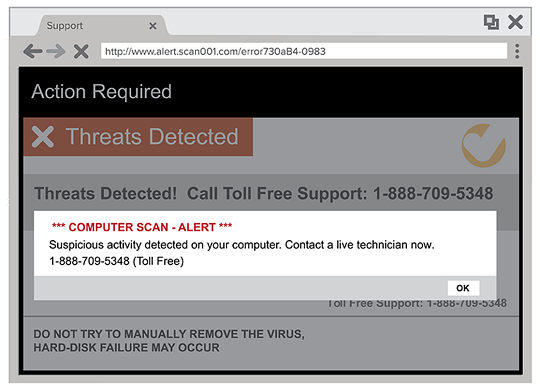

Security

Tech Support Scams

Your computer stops working, locked up, a tech is offering to help - STOP!! BUT NOW WHAT?

Community

Scotch-A-Roos

Do you have recipes in your mom's or a loved ones handwriting? Handed down and used repeatedly? Here is one of mine and definitely a favorite! Checkout our Facebook post and share yours there!

Security

Social Media Quizzes - Red Flag!

Aren't they cute? Those Social Media Quizzes that share fun facts with friends and family. Not really!

Community

Power of Community

April is National Community Banking Month. We enjoy our Community and being part of it!

Banking

Home Equity Line of Credit and Home Equity Loans

What are the Pros and Cons?

It may not make much sense for you to buy or build a home at this time. Maybe it makes more sense for you to make home improvements. But how would you be able to afford it? There are several options, including using your home’s equity through a home equity line of credit (HELOC) or a home equity loan.

Community

Creamed Asparagus on Toast

A delicious comfort food for any meal but always a hit for brunch!

Security

Shredding to Protect Your Idenity

April is Shred Month at Waldo State Bank

Community

Potato Pancakes .... or Waffles!

No Fish Fry can be complete without a good potato pancake. This recipe definitely fits that profile.

Security

Fraud and eCommerce

eCommerce and your Debit Card Safety Habits are important.

Banking

The 5 Most Common Fees Associated with Mortgage Loans

Whether this is your first time or your third, fees associated with mortgage loans can come as an unpleasant surprise. Costs like mortgage insurance and property taxes frequently catch buyers off-guard. Understanding these and other fees and budgeting for them will ensure a smooth financial transition to buying your home.

Community

Sherry's Recipe Corner: Scrumptious Salad

This salad recipe comes to us compliments of Lori Meyers this month. It is a welcome addition to any salad lineup and just in time for a lighter spring dish!

Security

Safer Internet Day

Keeping the kids of the future safe when online.

Community

Sherry's Recipe Corner: Mini Cheesecakes

All Super Bowl parties can use a sweet treat too! Enjoy these easy to make desserts at your gathering!

Security

Time for your Security New Year's Resolution!

It's not too late to make a New Year's Resolution to keep you Cyber Safe in 2022.

Community

Sherry's Recipe Corner: Jalapeno Popper Dip

Spice up your holidays with this tasty treat!

Security

How to Avoid Holiday Scams

The holidays bring joy to everyone who celebrates; full of presents, gift-giving, and goodwill. Unfortunately, scammers take advantage of these fun and happy times. Our financial experts at Waldo State Bank put together four of the most popular scams and ways to avoid them. Keep these scams in mind and you’ll add an added layer of protection to your finances and private personal information.

Security

Robbers - Behind the Scenes

Community

Sherry's Recipe Corner: Tasty Pecan Bars

Love Pecan Pie, but want to share with a crowd? Freeze some for future use? These are the bars for you. Tastes just like the pie!

Banking

6 Tips to Safe Holiday Shopping

It’s November! You know what that means… holiday shopping! We know the reason for the season isn't holiday shopping, but it's certainly a hot topic every year around our community. We're focusing on safe holiday shopping tips and how you can keep yourself and your wallet safe this holiday season.

Community

Christmas Tree of Giving

Join Waldo State Bank in making Christmas Bright with Project Angel Hugs.

Security

October is National Cybersecurity Awareness Month

October is National Cybersecurity Month Awareness Month! Keep safe this upcoming holiday season by taking this quiz and learn more about cybersecurity.

Community

Sherry's Recipe Corner: Creamy Pumpkin Torte

It sure is Pumpkin Spice season and Waldo State Bank is joining in! This month we feature a cool and creamy taste of pumpkin that sure hits the spot!

Banking

SAFE: Four Benefits to Mobile Banking

Online and mobile banking have revolutionized the way we take care of our money. But what is the difference between the two? And is mobile banking truly safe?

Security

Who doesn't like a Gift Card?

Gift cards are easy gifts to give to family, friends, and co-workers but did you know that scammers have figured out how to trick you using these gifts?

Community

Customer Appreciation Day 2021

We appreciate our banking customers near and far! Customer Appreciation Day was a success and we are so grateful to be serving our community.

Community

Sherry's Recipe Corner: Fall Off The Bone BBQ Ribs

Do you want to make restaurant-quality ribs at home that turn out every time? Look no further than this easy recipe that can be counted on time after time! The trick is in the cooking, but a good rub can add amazing flavor!

Banking

Funding for Your Education: Scholarship Opportunities

There are many ways to save for higher education, no matter where you are in your educational journey. Scholarship opportunities provide another method of helping the financial burden of students all over the world.

Banking

The Extra Credit Check: 7 Ways to Keep Good Credit in School

Did you exercise today? Did you take a break from your studies? Did you check your credit score? Not to say that you should be checking your credit score every day but checking your credit score as part of your routine will help you maintain a healthy financial well-being.

Community

Sherry's Recipe Corner: Seafood Delight

This recipe can be used as a spread with your favorite pita chip, cracker, Tostito, fresh veggies or pile it high on a hoagie roll and enjoy a seafood sandwich with lettuce and tomato!

Security

PayPal - How to Protect Your Information

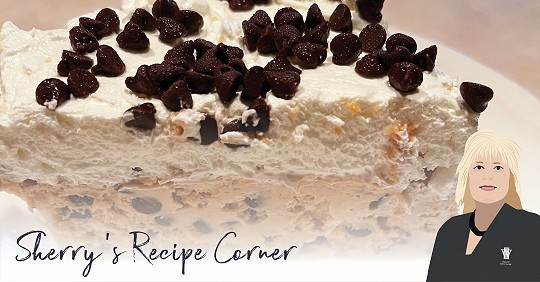

Community

Creamy Peanut Butter Dessert

Too hot to start your oven? This no-bake dessert shared by Lori Meyers is the perfect solution.

Banking

Making Your Money Grow in College: Investments and Savings for Your Future

53% of college students feel that they aren’t prepared to manage their money. How can you be ahead of the game and secure a financially fit future?

Security

Social Media Scams

Social media can be a great place but scammers take advantage of these vulnerable spaces. Protect yourself on social media by reading about these common scams.

Security

Protecting Your Digital Identity

Community

Chicken Teriyaki Dip

Tired of the same old Taco Dip? Share this and everyone will want the recipe!

Banking

How Banking Local Stimulates Your Local Economy

By supporting local, independent, and locally-owned businesses, including community banks, recirculate about 58% more revenue within the local community than large franchises and corporate companies.

Security

Have You Updated Your Device Lately?

Updating regularly and paying attention to when updates are available for your devices are key to your security. Some people look as updates as optional or fun user enhancements, which they can be.

Community

Lemon Dream Torte

Who doesn’t like the sunshine? Put a little in your dessert, add some love, and a few simple ingredients and you have a dessert to take anywhere – that you can keep it cold that is! It will be the highlight of any backyard BBQ!

Banking

Top 4 Reasons to Switch to a Community Bank

There are nearly 5,000 community banks in the United States, with 177 in Wisconsin. How do you choose the right banking partner for you? Why would you choose a community bank over the large retail branches? We have four reasons why.

Community

ICBA Chairman appoints Tom Reil to 2021 Housing Finance Subcommittee

The Independent Community Bankers of America (ICBA) today announced that local community banker Tom Reil, President of Waldo State Bank, 119 N. Depot Street, Waldo, WI 53093 was named to serve on ICBA’s 2021 Housing Finance Subcommittee. ICBA is the nation’s voice for community banks.

Community

Salmon with Garlic Cream Sauce

Salmon fillets crispy on the outside and tender and juicy on the inside are perfect for any seafood fanatic. The whole family will enjoy this easy recipe along with the creamy garlic cream sauce.

Community

The Power of Community in Community Banks

During the week of April 19-24, 2021, Waldo State Bank and others across Wisconsin will participate in the Wisconsin Bankers Association Power of Community Week. Help our team as they beautify the Village of Waldo through a Clean-Up Program and raise funds for the Waldo Fire Department.

Security

Vaccination Scam Awareness

Exicted to be Vaccinated? Don't share a picture!

Security

When It's Not the Government Calling

Scams are at record highs and have no end in sight. This month we review information the Federal Trade Commission (FTC) provided on how to spot the scammers.

Community

The Easiest Peanut Butter Pie Recipe

Happy Pi(e) Day! This recipe is probably the easiest Peanut Butter Pie recipe you'll come across!

Community

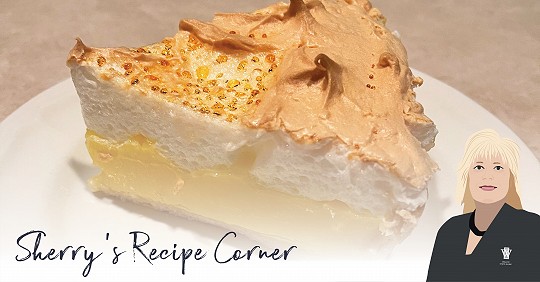

Easy Lemon Meringue Pie Recipe

Easy-peasy-lemon-squeezy! This recipe for lemon meringue pie will surely want people coming back for more!

Community

Raspberry Sugar Cream Pie Recipe

For every level of pie enthusiast, this recipe for Raspberry Sugar Cream pie will be appreciated!

Banking

5 Facts Your Business Should Know about the PPP

Is your company eligible for round #2 of the Paycheck Protection Program Loan through the Small Business Administration? As the deadline approaches, Waldo is here to help small businesses apply, whether or not you’re a current customer.

News

Banking Updates

As we continue to monitor daily changes to the market and laws mandated by the state and federal government, we want you to know that you are our priority. To keep you updated, we are compiling the most current, reliable information here as it becomes available to us. Please check back to get the latest news and to see how we can serve your financial needs during this time.

Security

Wire Fraud - It's not going away!

Wire fraud is a stealthy type of fraud that keeps surfacing. We want to re-visit this as a reminder to be ever vigilant.

Community

Caramelized Onion Meat Loaf

This recipe is so good you may want to eat the whole thing!

Banking

Rent or Buy: What Fits Your Lifestyle?

An estimated 811,000 homes were sold in 2020, making an 18.8% increase in the number of homes sold in 2019.

Security

National Data Privacy Day

Privacy is Important Every Day!

Community

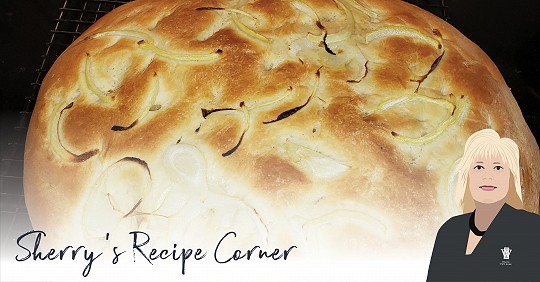

Sherry's Recipe Corner: Stuffed Focaccia Bread

Sherry’s Recipe Corner is featuring a game day appetizer that is unique and delicious for any crowd!

Banking

5 Easy Steps for Homebuyers

Homeownership is such an exciting milestone in a person's life! Whether you are newlyweds, retired, or anywhere in between, it's refreshing to have a new space to call your own. The home buying process can go as slow or as fast as you care to move, but one thing is for sure, the more your finances are in order, the sooner you can take that exciting step towards homeownership. However, before you jump in, our financial experts laid out five steps in preparation for your future home quickly, efficiently, and confidently.

Community

Sherry’s Recipe Corner: Cranberry Shortbread Bars

Sherry’s Cranberry Shortbread Bars are a delicious sweet treat that melts in your mouth!

Community

Sherry’s Recipe Corner: Candy Cane Dreams

We have a perfect combination of chocolate and peppermint just in time for the holidays!

Security

The Generation Gap

Family is everything! Tips for protecting those you love!

Banking

5 Tips for Your Financial Resolutions

They say, "hindsight is 20/20," and this couldn't be truer in 2020, especially when it comes to finances! The best way to tackle what 2021 brings is to ensure you are mindful of your finances and have a plan in place that fits your needs. We've compiled our top five tips on building successful financial resolutions that will last throughout the new year and beyond.

Community

Sherry’s Recipe Corner: Cream of Turkey and Orzo Soup

Thinking about what to do with your left-over turkey from Thanksgiving? This recipe is a delicious and flexible choice.

Security

Social Engineering Attacks

Social Engineering is on the rise. What is it?

Community

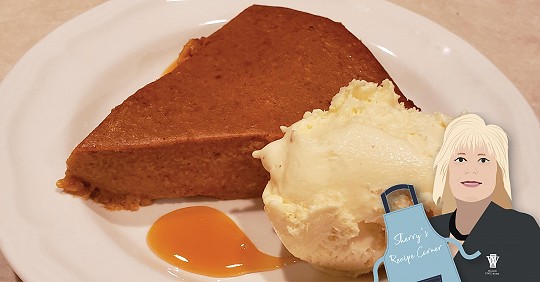

Sherry's Recipe Corner: Crustless Pumpkin Pie

This classic pumpkin pie recipe was tweaked so you still enjoy the benefits without the extra sugar. You won’t miss the crust!

Banking

The Giving Season: 6 Tips on how to give and save for the holidays

Despite the lights, smells of comfort foods, and sights of home, the holiday season can still bring uneasiness when giving responsibly. We understand the need to optimize your hard-earned dollar, so our experts compiled a list of six quick tips to help you give and save this holiday season.

Community

The Giving Tree: Project Angel Hugs

Vanessa Jensema was a brave six-year-old girl undergoing treatment for leukemia. During her treatment, she wanted to spread joy and hope to other children battling cancer. Her giving heart and strong faith created “Nessa’s Project.” After her passing, her spirit lived on through “Nessa’s Project” and evolved into Project Angel Hugs.

Community

Recipe for Success: The Great Pumpkin Dessert

Whether you are ready to watch “It’s the Great Pumpkin, Charlie Brown” or thinking ahead to Thanksgiving, this dessert is sure to please. Not only is it super easy, but stores well in the refrigerator and is delicious served warm or cold. It has been a family favorite for years.

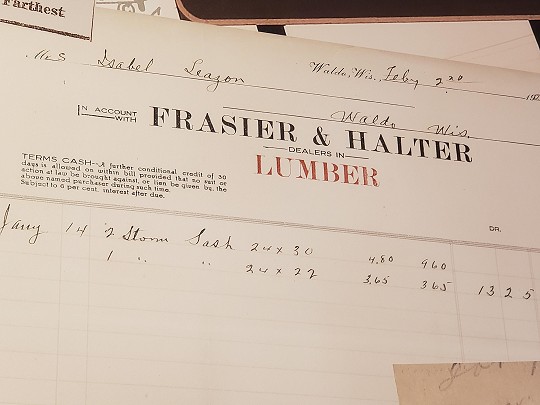

History

The Lumber Yard: Waldo History with a Touch of Controversy

Leicht's Waldo Café is now located in the lumber yard. They are a family-owned and operated restaurant serving American cuisine. But their origin story is a bit unique.

Banking

Seven Ways to Reach Financial Goals for Your Small Business

Over 105 Years of Servicing the Community

Our experts have compiled the seven most important insights you need to know when considering your business's financing options. Waldo State Bank offers various commercial lending tools, and we’ve tailored this information to small business needs.

Security

Take Inventory of Your Security

Banking

Budgeting Tips for Your Teen in the Driver's Seat!

Driving is considered a pivotal moment in a teen's life. The freedom of being able to go anywhere with anyone at any time is liberating! However, having this freedom can bring significant responsibilities to the new driver and anxiety to parents who have to hand over the keys. Check out some tips below on how to prepare for your teen driver.

Security

Extended Warranty??

Who hasn't gotten one of the extended warranty calls?! They are frustrating and never-ending. With the rise of these calls, people are turning to robocall blocking apps.

Banking

Debit vs. Credit Cards: What’s the Best for Your Financial Situation?

Pin or No Pin... That is the Question!

Community

Recipe for Success: Game Day Chili & Homemade Cornbread

This month's featured favorite recipe is the perfect Game Day Chili with Homemade Cornbread to complete your tailgate tradition!

Banking

11 Financial Questions You Should Ask Before Tying The Knot

If you're engaged or thinking about getting married, you've probably talked about a lot of things. If you want kids or not, where you want to live, how you view religion and politics, hopes and dreams for the future, whether toilet paper should be rolled under or over, and so much more. But something that will impact all of these things (besides maybe which way you roll your toilet paper) is something not a lot of people like talking about; finances.

Community

Recipe for Success: Rhubarb Pie

This month, Sherry, our compliance officer, shares her recipe for the perfect summer dessert, rhubarb pie!

Banking

13 Ways to Save on Your Monthly Bills

While individually, they may seem small, monthly bills add up quickly. They account for a significant portion of monthly expenditures, which is why regularly assessing them and looking for opportunities to save can impact your budget and finances. Not sure where to start? Have no fear; our financial experts are here to help you save!

Security

10 Steps To Avoid Coronavirus Scams

With an 11% rise in online financial scams and over $13.44 million lost in just four months since the onset of the coronavirus pandemic, it is crucial to be vigilant now more than ever in protecting yourself and loved ones from financial scams.

Community

Recipe for Success: Easy Two Layer Lasagna

Happy National Lasagna Day! You bet we weren’t going to miss this opportunity to share a recipe for success!

Banking

How to Manage Your Finances During a Recession

After the longest economic expansion in U.S. History, the National Bureau of Economic Research (NBER) has declared a recession, leaving many wondering how to prepare. It’s normal to feel uncertain during these times, but we want to help you feel confident with these tips from our financial experts on managing your finances during a recession.

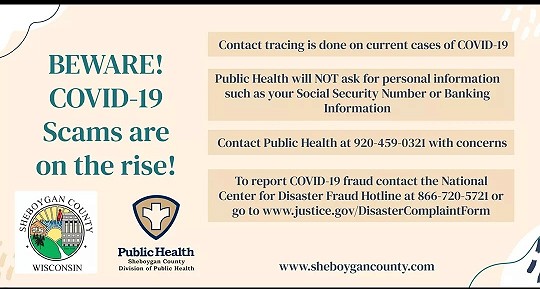

Security

Covid-19 Scams and How to Report Them

Banking

Waldo State Bank’s 5 Steps to Raising Financially Savvy Kids

With 41% of young adults receiving no formal financial education, 68% of young adults financially at risk or financially precarious, and over 50% reporting their parents having the most influence on their financial education, it’s important now more than ever for parents to take a leading role in financial literacy for their children. Not sure where to begin? Don’t worry, our financial experts at Waldo State Bank put together five steps to raising financially smart kids.

Security

Children's App Safety

Screen time is something most kids are familiar with. Parents monitor which apps their kids can access. But have you considered what commercials are in those apps?

Community

Recipe for Success: BBQ Whiskey Chicken Skewers

Are you looking for the perfect recipe for your next summer cookout? Look no further than these BBQ whiskey chicken skewers!

Banking

5 Tips for Saving for Your Next Vacation

With recent global events, many people have had to cancel their family vacations this summer, and, worse, without a refund. So how do you save for another family vacation without breaking the bank or going into debt? Have no fear; you’ll be sipping Mai Tai’s on a beach in no time with these five tips from our financial experts!

Community

The Top 5 Ways to Finance Your Future at College

Whether you’re a parent or a recent high school graduate, the rising cost of college - especially in light of recent economic turmoil - is no small concern. It’s no secret college is expensive, and now paying for college isn't either! Our finance experts came up with "The Top 5 Ways to Finance Your Future at College."

Community

Recipe for Success: Jalepeno Cheddar Bread

This month, our compliance officer, Sherry, shares another one of her famous recipes; Jalepeno Chedder Bread.

Security

Corona Virus Scams

Banking

The Top 5 Things You Should Know About Real Estate Loans

So, you’re considering buying a property, but where do you even begin with real estate financing? How do you get a real estate loan? What financing costs should you be aware of? How do mortgage rates work? Should you paint the house green or blue? So many questions! While we may not be the most qualified to advise on paint colors, we do have a team of lending experts at Waldo State Bank who put together the top five things you should know about real estate loans.

News

Support from Waldo: A Letter From President Reil

To all of our Waldo State Bank Customers,

I wanted to write and share how Waldo State Bank is navigating these unprecedented times to continue serving you with the unmatched service and care we are so proud to provide you. The safety of our customers and employees is our number one priority. While we miss the warm conversations and smiling faces in our lobby every day, we want to assure you we’re still here and committed to serving you with uncompromised dedication, even from a safe social distance.

Community

Recipe for Success: Perfect Pantry Pizza

So you’re in quarantine, trying to limit grocery store runs and maintain social distancing, and then it hits… you get the undeniable craving for pizza and there’s no premade crust to be found in your pantry. Well, you’re in luck, our compliance officer, Sherry, also got that craving this week and shared her secret recipe for the perfect “pantry pizza crust,” that you can make with ingredients you likely already have on hand.

Banking

Is Refinancing Your Home Right for You?

With economic uncertainty and sliding interest rates, many people are looking at lending options to help them secure their future or reduce expenses, including refinancing their home. Let’s explore how refinancing a mortgage works, and if refinancing is right for you.

Security

Working from Home Security Tips

With many businesses now having employees working from home we want to highlight the importance of good security practices.

News

Tax Deadline Update

In light of the national state of emergency due to the COVID-19 pandemic, the Internal Revenue Service (IRS) has extended both tax filing and tax payment deadlines until July 15 for Federal Income Taxes. Here are a couple of things worth noting that may affect you:

News

UPDATE: Emergency Response to COVID-19 Virus

For the safety of our customers, employees, and community, Waldo State Bank will be moving to drive-thru access only beginning Tuesday, March 17. Continue reading for more information.

News

Emergency Response: Your Security and Safety – Our Priority

Waldo State Bank is monitoring the COVID-19 Virus and while we remain open to serve our customers, you are our number one concern. We would encourage you to use caution and follow the recommendations of the CDC pertaining to the Virus as they unfold.

We are continually sanitizing and maintaining as healthy of an environment as possible and also offer remote banking services for your convenience, online, and through our mobile app.

Community

Recipe for Success: Luck of the Irish Cheesecake (for Instant Pot)

This month, one of our Customer Service Representatives, Kari, is sharing her recipe for Luck of the Irish Instant Pot Cheesecake! Just when we thought Instant Pots couldn't possibly make one more thing, Kari shared this incredible treat with us!

Banking

Personal Loans Made Easy

When searching for financial solutions to some of life’s unexpected costs or large purchases, people often turn to high-interest credit cards to float their financial needs. Unfortunately, this means consumers often end up spending hundreds of dollars more in interest, but there is a better solution! Enter personal loans.

Banking

When Should You Start Saving for Retirement?

If you are like 56% of Americans, you might not know how much you need to retire and are probably even less sure about when and how to start working towards a retirement goal. You might also be one of the 22% of Americans who have $5k or less in retirement savings, or maybe you’re one of 15% that don’t have any retirement savings at all. The point is, wherever you are in your retirement journey, you certainly are not alone. And while it’s never too late to start saving for retirement, when you start significantly impacts your financial return and retirement strategy. So what factors should you consider when creating a retirement strategy?

Banking

What is an IRA Anyway?

You’ve likely heard the term IRA (Individual Retirement Account) before, among a bewildering amount of other retirement jargon. However, like many people, you’re probably still not sure what it is and what it can do for you. So, pull up a chair, grab a cup of coffee, and let’s talk about IRAs in plain English.

Community

Recipe for Success: Aunt Connie’s Baked Bean Casserole

Our Vice President and Chief Loan Officer, Derrick, is sharing his Aunt Connie’s Baked Bean Casserole! According to Derrick, this casserole is magic, and we agree! Give the recipe a try for yourself.

Security

Mobile Payment Protection

The Federal Trade Commission (FTC) shares tips on protecting yourself from scams when dealing with mobile payments.

Banking

Leveraging Your HSA for Retirement

What is the best way to leverage your Health Savings Account (HAS) for retirement? Let’s explore an interest-bearing HSA account at Waldo State Bank.

Security

Small Business Security Tips

Small Business

Banking

Advantages of an HSA Account

You have your 401(k), your IRA, your savings account, and your checking account. You name it; you’re on top of it. But, do you have an HSA account? With a bit of strategy, an HSA account can be an excellent tool to cover current medical expenses and help you save long-term. HSA accounts can even offer considerable benefits after retirement and can serve as a good retirement savings strategy. Open an interest-bearing HSA account at Waldo State Bank and take advantage of our competitive rates and helpful team!

Community

Recipe for Success: Buffalo Chicken Dip

Are you ready for game day? Gear up with our featured Buffalo Chicken Dip. This recipe is quick and simple, so you don’t have to worry about missing kickoff!

Banking

How to Save Money After the Holidays

The holidays are an exciting and wonderful time of year, but they can also be very expensive! Pricey gifts, festive decorations, ugly sweaters, and big family dinners can add up quickly before you find yourself way over budget. There's no reason to feel discouraged, however. After all, the holidays are all about feeling good and feeling the love from those around you. And because Waldo State Bank cares about our customers, we've prepared some tips in case you find yourself in over your head after the holidays!

Security

Holiday Shopping and Internet-Connected Toys

Community

Recipe for Success: Tammy's Caramel Corn

For many years, Tammy, our Loan Servicing Specialist, has been treating our team to her homemade caramel corn! It quickly became a bank favorite, and we are excited to share it with you.

Banking

Tips for Saving as a Young Adult

The "young adult" phase of life is important for many reasons. It's during this time that people enter college or the workforce. Some young adults may even start families or venture into entrepreneurship at this time. No matter how this period plays out, there is one common truth about the young adult years - they are the most pivotal years for investing and saving for the future.

Banking

Growth and Safety of CD Accounts

Certificate of Deposit (CD) accounts are one of the safest ways to grow your money and receive a great rate. Investors choose CDs due to their low risk and high yield. CDs are FDIC-insured accounts that offer a broad range of maturity rates and returns. At Waldo State Bank, our personable staff helps guide our customers towards discovering the best rates for CD accounts that will help them reach both their short-term and long-term goals.

Security

Safe Social Media Use

Social media is a great way to stay in touch with friends and family. Here are some tips on helping to protect your information while you’re on social media.

Community

Recipe for Success: Ashley Lawrence’s Scarily Good Salad

For Halloween, our team had a scary good potluck! One of the dishes brought to pass was Ashley Lawrence’s Scarily Good Salad – it had our team spooked by how delicious it was. Give this salad a try for yourself!

History

Invest In A Rich History

Waldo State Bank was established in 1913 as an independently owned community bank. For over 107 years, we have committed ourselves to providing Sheboygan county residents and business owners with expert banking services, striving to achieve our mission by offering genuine customer service with the highest degree of integrity, professionalism, and confidentiality. These founding principles have led us to develop a rich history of lifelong, trusted relationships with our customers.

Banking

The Benefits of Depositing at Waldo State Bank

At Waldo State Bank, we know that customers have a never-ending list of banking options to choose from. Our staff receives the same bombardments of corporate bank offers and postcards in our mailboxes that everyone else does! So what sets us apart? Why should you choose to deposit with Waldo State Bank?

News

Ready for a New Device? Beware of Scams!

Security

Mobile App Scams

Apps are a fantastic way to access information, speed up shopping, or learn! Unfortunately, that opens the door to scams. Check out these tips from the Better Business Bureau to avoid scams:

Banking

Committed to Our Customers For Life!

While large corporate banks will treat their customers like numbers, providing cold and impersonal interactions, Waldo State Bank’s staff gets to know all of our customers by name. We listen to their stories and offer personalized service that helps each of them reach their individual goals. At Waldo State Bank, our customers are like our extended family!

Community

Recipe for Success: Lynn Floods' Mozzarella Pretzel Dip

Fall has arrived bringing with it weekends full of football and cozy evenings by the fire. If you’re looking for the perfect snack to accompany your fall activities, look no further. Our Waldo State Bank team gave Lynn Flood’s Mozzarella Pretzel Dip a taste test and it quite the treat! Make this party-approved recipe for yourself!

Community

Recipe for Success: Paul & Mia’s Chocolate Peanut Butter Balls

Waldo State Bank has the ingredients to help you find success in your financial goals and aspirations, but we’ve taken to asking our team members and customers to help us share some of their favorite food recipes from home! Ted Katsma, our Deposit Operations Officer, shares his recipe for “Paul & Mia’s Chocolate Peanut Butter Balls.”

Banking

CD Accounts – A Safe and Secure Investment

Investing personal wealth to earn a substantial return isn't a simple trick. There is a lot of important information to research and understand the different options available, as well as the risks and benefits associated with each. Stocks and CD accounts are two popular investment types with very different approaches toward earning returns. While stocks are popular, Waldo State Bank would like to point out the reasons CDs are a safer, more beneficial choice for investing your money.

Community

Waldo State Bank Team Volunteers With Project Angel Hugs

Waldo State Bank supports Project Angel Hugs, a non-profit dedicated to nurturing a passion for Christ-centered service and ministering to the emotional needs of children touched by cancer and their families.