5 Steps to Increasing Your Personal Savings

While most people would agree that it’s important to save, according to a survey since the pandemic, 40% of Americans said they have less than $300 in their savings. So, if everyone thinks it’s a great idea but less than half of America is doing it, how can you be successful in saving money? Let’s break it down into five easy steps to increase your savings:

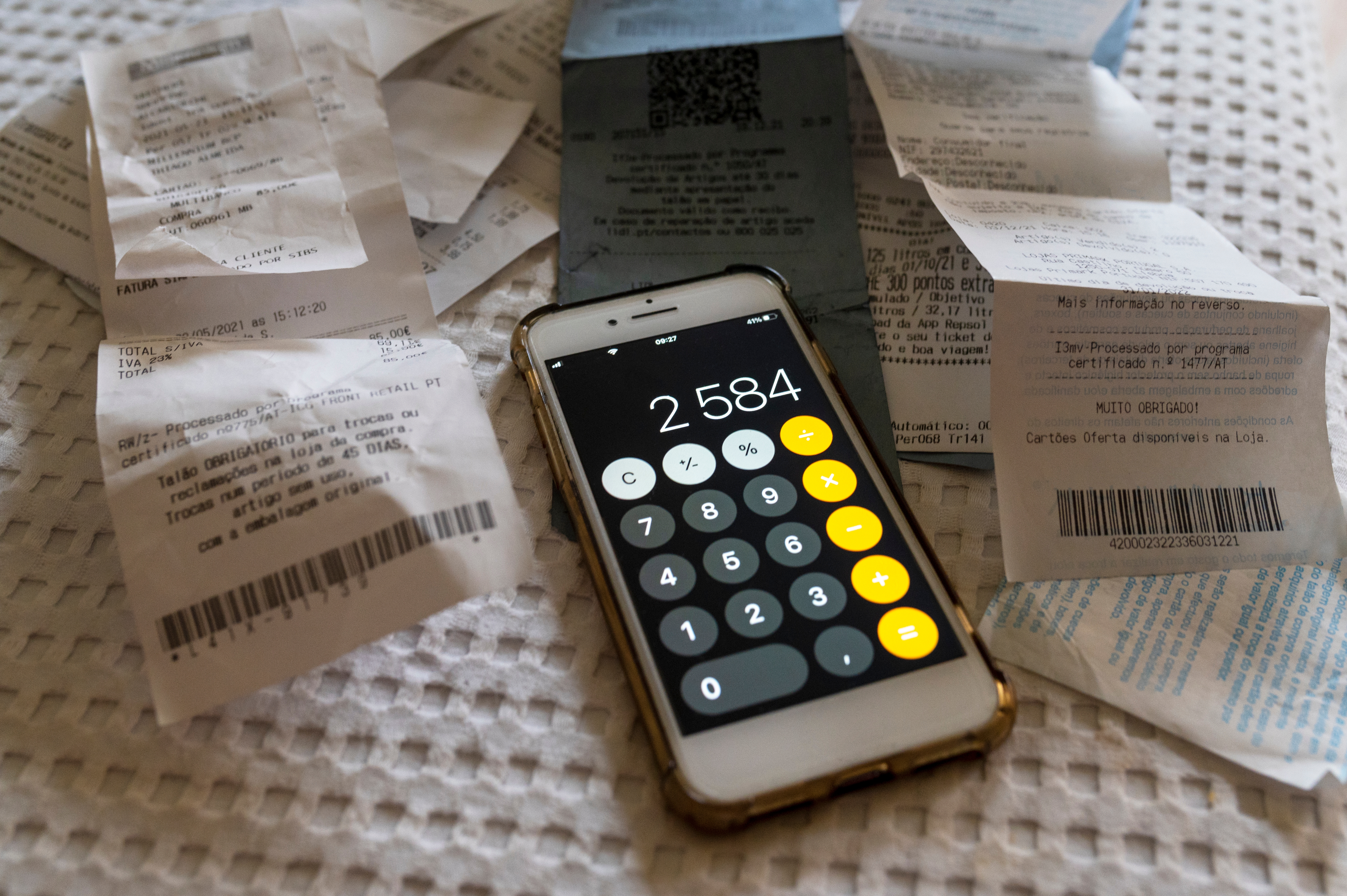

Track Spending

The first step towards saving money is to see where your money is going in the first place. While most people have a general idea of what they spend their money on, without actually tracking your spending to see the bottom line, it’s easy to miss just how much of your money is being spent and what it’s being spent on.

Once you see where your money is being spent, you can easily reevaluate your spending habits and set clear goals, which brings us to our next step...

Set a Goal

Most people only save what they have left over at the end of a pay period, but without a clear goal in mind and strategy to accomplish it, it’s far less likely that you will have much left to save.

You should consider establishing savings goals for both short-term and long-term financial success. For example, a short-term goal may be a family vacation, and a long-term goal may be setting yourself up for retirement. While planning your strategy, it is crucial to consider a balance between both; your future should not come at the cost of your current living, and the opposite is also true.

Once you have your goals set, it’s time to create a strategy, otherwise known as your budget.

Create a Budget

A lot of people shy away from the word budget because they think it will limit them financially. In reality, it is the basis towards financial freedom as it empowers you to take control of your finances and reach your goals. Think of your budget as your strategy to navigate your finances; it allows you to allocate funds, plan for your future, and cultivate the lifestyle you aspire to.

One general rule to follow as you make your budget is the 50/30/20 rule: fifty percent of your budget should go to “needs”, such as rent, food, utilities, thirty percent should go to “wants” to maintain your lifestyle, and twenty percent should go towards saving and investing for your future.

Stick to it!

The next step is to stick to your budget! While life happens and budgets sometimes have to change, things that will help you stick to your budget and reach your goals are planning ahead, automating savings, and reducing bad debt.

Plan Ahead

Part of having a budget is also planning to safeguard your future; this includes saving for big purchases and emergencies and insuring your assets. By doing so, larger expenses that come up will not completely devastate your financial stability.

For example, the most expensive wonderful time of the year, Christmas, can be devastating to any budget if not planned for. However, by planning ahead with a Waldo State Bank Christmas Club savings account, you can reduce the financial stress of the holidays and ultimately safeguard your budget.

Automate Savings

Sometimes the easiest way to save is by automating a deposit to your savings account. If you never see the money in your checking account, it’s often easier to avoid spending it on things it shouldn’t be.

Reduce Bad Debt

There are many types of debt, many of them “good debt” that will increase your net worth or have future value. Some examples are student loans, small business expenses, or mortgage loans. However, especially when you’re trying to increase your savings, it’s essential to evaluate your debts and reduce “bad debt.”

"Bad debt" are expenses involved in decreasing your overall net worth. This may include auto loans or credit card debt. Reducing “bad debt” helps to increase your net worth and provide future value.

Our loan officers at Waldo State Bank can help you evaluate your debt and structure a pay off. They can also help you consolidate your debt and make payments more manageable. By reducing “bad debt,” you will reduce financial strain and enable increased savings.

Take Advantage of Specialty Savings Accounts

Last but not least, put your savings to work for you! Not all saving accounts are created equal, so consider carefully the most advantageous savings account to reach your goals. A couple of savings accounts that offer special advantages are Health Savings Accounts and Individual Retirement Accounts.

Health Savings Accounts (HSAs)

HSAs don’t just help you save for medical expenses but also saves you money through tax-advantages and even employer contributions. Do you want to learn more about HSAs? Check out our blogs about the Advantages of a Health Savings Account and Leveraging Your HSA for Retirement.

Individual Retirement Accounts (IRAs)

Many retirement options are only offered through employers; however, there are also Individual Retirement Accounts (IRAs) that provide significant tax advantages. Do you want to learn more about IRAs? Check out our blog, “What is an IRA anyway?” Or, if you’re not sure where to start with retirement savings, check out our blog, “When should you start saving for retirement?”

Are you interested in how you can reach your savings goals? Contact us today to speak with one of our financial experts.

*Originally published on 5/20/2020.