SAFE: Four Benefits to Mobile Banking

Recently Posted

Technological advancements have allowed the banking industry the ability to provide more convenient banking solutions. Although still necessary, brick-and-mortar banking locations have decreased in popularity thanks to online and mobile banking.

The pandemic increased the need for these technological advancements and accelerated digitally dependent lifestyles. During the early months of the pandemic, mobile banking registrations skyrocketed to 200% over the daily average.1 The number of registrations continued to grow along with mobile banking app activity at that time.2 People felt safer and were more attracted to the convenience that online and mobile banking provided.

The Difference Between Online and Mobile Banking

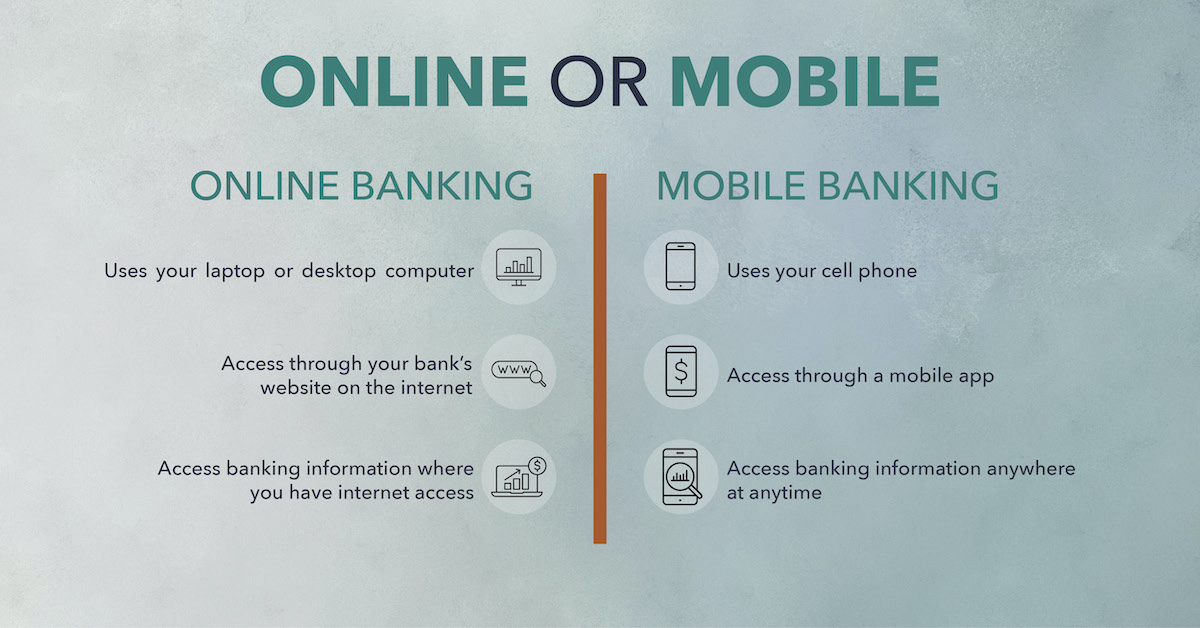

Online (or internet) and mobile banking offerings are used together but have different capabilities. The most notable difference between the two is the way you access your banking services. Mobile banking is often accessed through an app on a cell phone, while online banking uses the internet, usually through your bank's website, on a laptop or desktop computer.

Mobile banking offers you access to the most common and standard banking needs, but you are not limited to where you access this information. These tools are located on your mobile device and accessed anywhere there is cell phone coverage. While both provide the ability to deposit checks, access your accounts, transfer money, pay bills, and locate A.T.M.s, online banking can also provide you with other basic activities like viewing or printing statements or applying for loans or credit cards.

While both online and mobile banking has increased in popularity over the years, 76% of Americans bank using their mobile app.5 With an overwhelming 57 million mobile banking users in the United States, these statistics don’t come as a surprise. The convenience of mobile banking and many other benefits outshine online banking.

S.A.F.E. Benefits of Mobile Banking

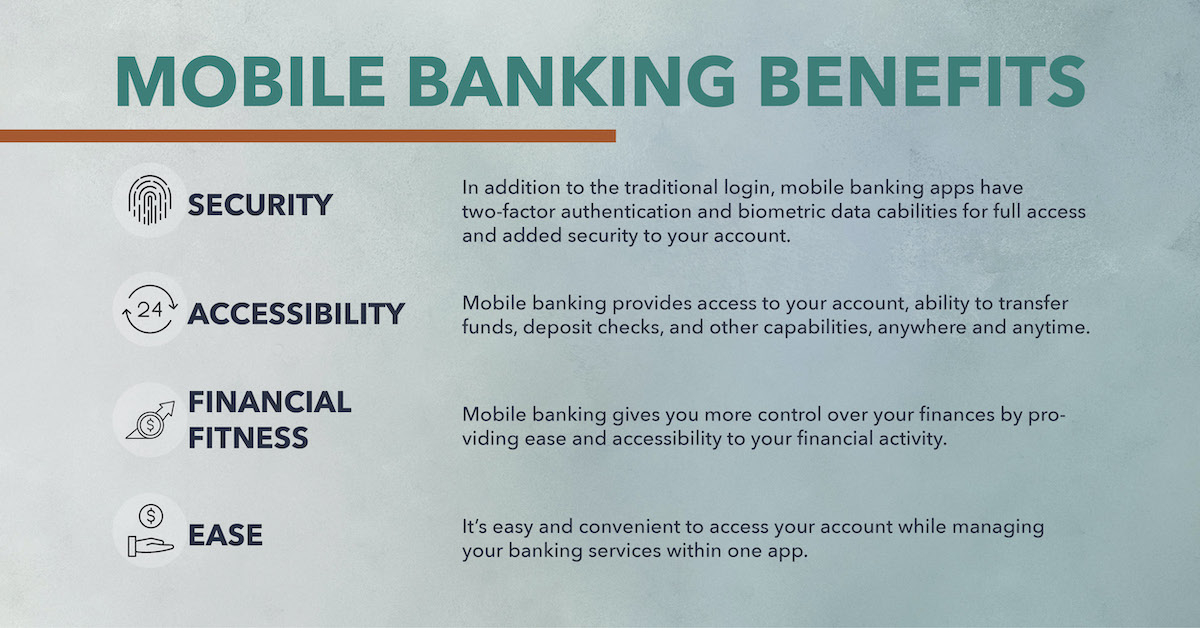

Security. Accessibility. Financial Fitness. Ease.

These are some of the benefits that Waldo State Bank provides to our banking customers no matter where they are. Below are some of the benefits that mobile banking has to our customers:

Security

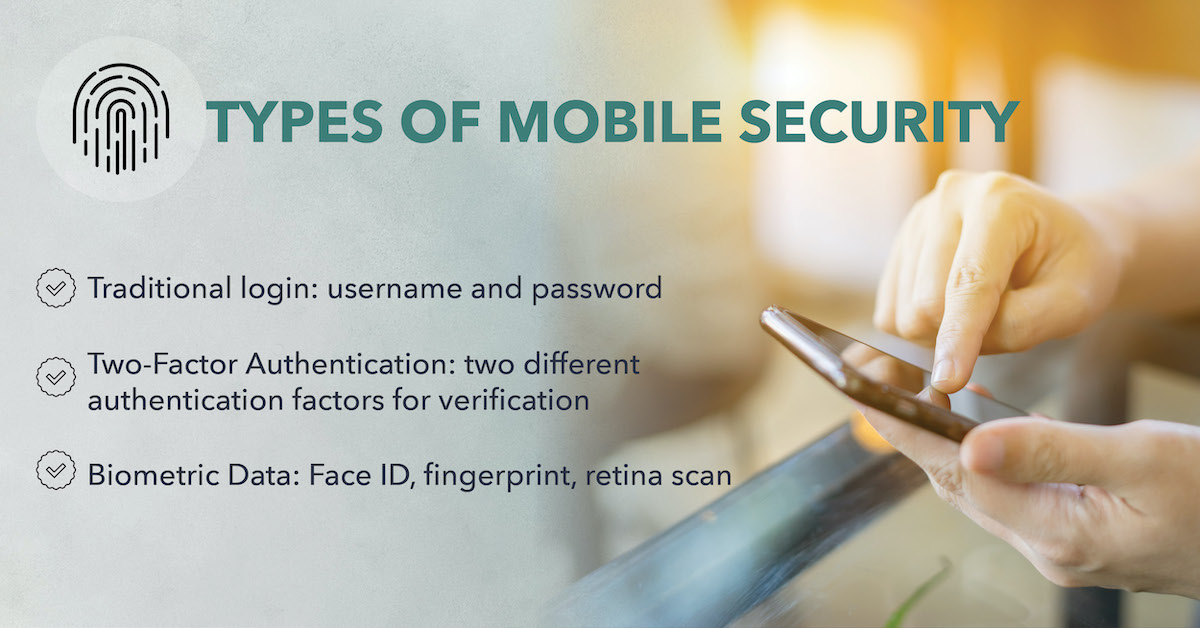

Financial institutions will always tell you that security is their top priority, and regardless of the method of banking, this holds true. Mobile banking is no exception. Online and mobile banking have risks, but mobile banking has additional security measures that ensure safe banking.

In addition to traditional usernames and passwords, mobile banking has other safeguards to access your banking information. Two-factor authentication provides an additional layer of security to make it even more difficult for other people to access your online accounts.7 Biometric data like fingerprint or Face ID provide extra security to your banking information.8

Most apps living on your cell phone need to be individually accessed to use the app. Mobile banking is the same way, thus adding another form of security. Even if you misplace your cell phone, someone would have to access your mobile device and then access your app using your username, password, and other security measures you have set in place like the examples above.

Suspicious activity can happen at any time on your account, so it's important to stay vigilant on your balances and accounts. Mobile banking allows you to catch any suspicious transactions that happen. In addition to being able to look at suspicious activity, if you've ever left your debit card behind somewhere, instead of canceling it and going through the hassle of ordering the new debit card, you can pause the card. Our Waldo State Bank mobile banking app has SecurLock – enabling you to temporarily turn your card off and turn it back on again.

Accessibility

Mobile banking allows you to check your account balances, find A.T.M. locations, transfer funds, and even deposit checks from anywhere, 24/7. You're no longer limited to visiting a brick-and-mortar branch during set visiting hours. You don't have to worry about our branch closing if you need to transfer money into your account or need to pay your bill after hours. You're able to monitor your spending anytime and anywhere.

This flexibility and accessibility is especially important to college students or even small businesses. As of 2019, 86% of college students used mobile payment methods instead of traditional debit cards.10 Sixty-one percent of small business customers now use their bank’s mobile app.11

Even though we love when our customers visit us, mobile banking provides you with time-saving capabilities without needing to come to our branch. You can take us with you wherever you go!

Financial Fitness

Our previous blog, “7 Ways to Keep Good Credit in School”, referenced that six in ten adults identified money and finances as the most significant sources of personal stress.12 Mobile banking apps provide a means for our customers to understand where their finances are, how it's going, and how to improve their financial health.13 It allows our customers to budget more effectively by understanding spending habits. It can also help with preventing overdrafts and pay bills on time.

Mobile banking helps customers keep all finances under control, so they're able to monitor their balances, receive account alerts, transfer money instantly, check deposits, and do much more. Having this amount of control at your fingertips provides confidence in the way you manage your finances. Ninety-five percent of respondents who used mobile banking knew their exact account balance compared with 85% of non-mobile banking customers.14

Ease

Everyone is looking for the most convenient means of doing everyday life, and banking is no exception. Internet access allows you to do most of your banking on a laptop, computer, or tablet without having to visit a branch. Mobile banking provides an even more convenient means of accessing your account. From your cell phone, you can utilize your banking information and tools from anywhere.

For small business owners, managing your business becomes more manageable with a mobile banking app. Managing your accounts and paying expenses is easy and all at your fingertips. Customer satisfaction rates amongst small business banking customers have increased in current years by using mobile banking capabilities.15

Specific features that are now made easy on a mobile app are favorited amongst customers. In a recent survey by Forbes, the top three most valuable features within mobile apps were mobile check deposit (35%), viewing statements and account balances (33%), the ability to transfer funds between accounts (31%).16 These features are quick and easy to use on your mobile device.

So What?

Online (or internet) banking can help you control your finances and maintain a financially fit life but take it a step further and take advantage of mobile banking. Opportunities for financial convenience, flexibility, and confidence are all possible with mobile banking. Did we mention it’s also free?!

At Waldo State Bank, we want to provide SAFE banking for all, no matter where you are. Get the most out of your online and mobile banking experience by contacting Waldo State Bank.